2 min read

AGC Inc. Decides to Launch Voluntary Tender Offer for Shares of Molmed

AGC Biologics March 17, 2020 at 9:54 AM

Tokyo, March 17, 2020 – AGC Inc., (Headquarters: Tokyo; President & CEO: Takuya Shimamura) has decided to launch a voluntary tender offer (“VTO”) to acquire all ordinary shares of Molecular Medicine S.p.A. (“Molmed”) a company with shares listed on the Italian Stock Exchange (Milan) pursuant to article 102, first paragraph, of the Italy Legislative Decree No. 58 of 24 February 1998 and related regulations. Molmed is a clinical stage biotechnology company focused on research, development, manufacturing and clinical validation of gene & cell therapies, and offers GMP services for the development and manufacturing of gene & cell therapies for third parties and/or in partnership at its authorized facilities (“CDMO Services”*1).

The VTO aims to obtain all of the issued shares of Molmed (463,450,672) at 0.518 Euros/share, amounting to 240 Million Euros if all of the shares are successfully acquired, and the subsequent delisting of the Issuer from the Italian Stock Exchange. This VTO is subject to certain conditions (e.g. the acceptances of the VTO of a number of shares representing not lower than 66.7% of the entire share capital), and is more fully described in the notice to the market issued in accordance with Italian law. Further details of the VTO will be contained in the offer document which will be published in the next few weeks.

This VTO is backed by Molmed’s largest shareholder, Fininvest S.p.A. (holding 23.13% of the shares of Molmed) which has irrevocably undertaken to bring all of its Molmed shares in the VTO, and we expect endorsement from Molmed management as well.

Gene & cell therapy is an innovative therapeutic method, that aim to treat diseases that do not have adequate treatments to date. Approximately 1000 clinical trials are underway worldwide, and the market is expected to grow at a rapid rate. Molmed as strength especially in vectors and cells manufacturing backed by its robust production platform, also providing third party GMP manufacturing services of engineered cells and viral vectors for various companies from large biopharmaceuticals to biotech companies.

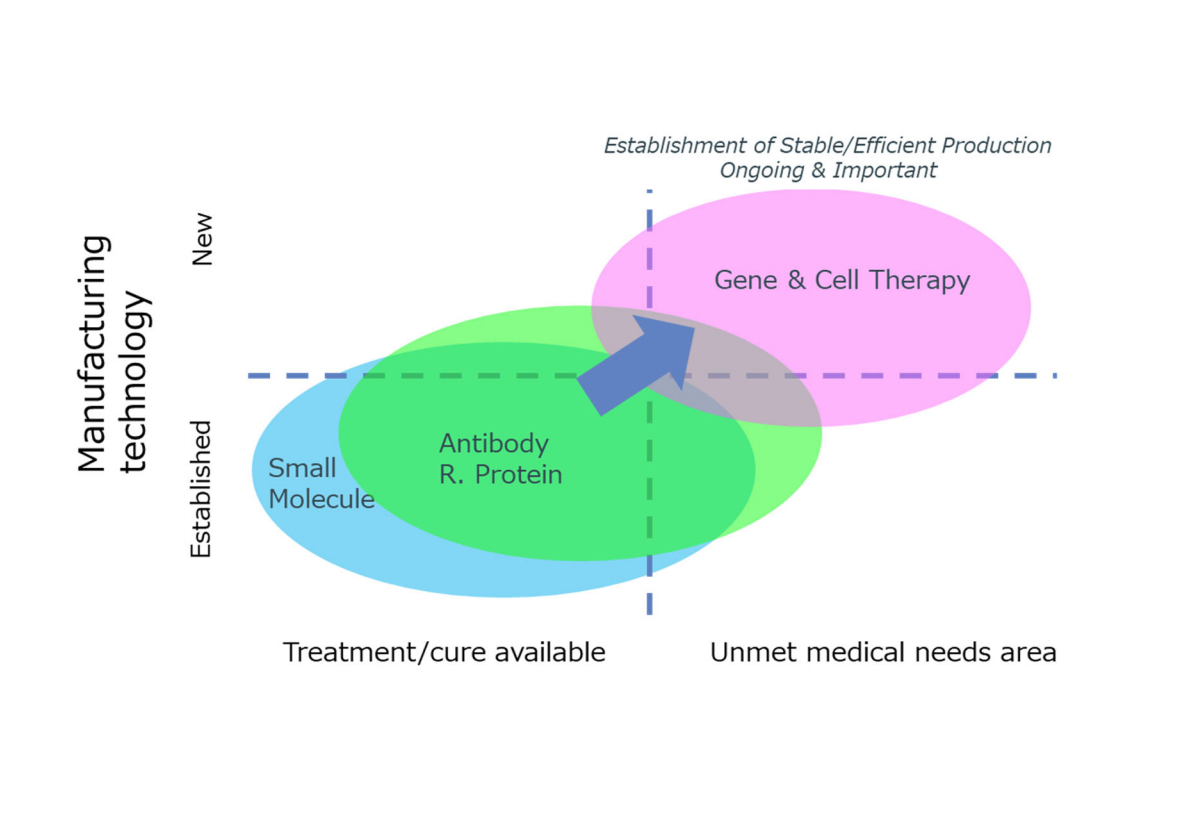

Under its AGC plus management policy, the AGC Group has made a commitment to position its life-sciences related business, including the biopharmaceutical CDMO business, as one of its strategic initiatives, aiming at sales above the 100-billion-yen range by 2025. To date, AGC has actively invested in its small molecule pharmaceutical CDMO business and its biopharmaceutical CDMO business, and has established a stable presence in the industry. Through the acquisition of Molmed, AGC will enter into the innovative gene & cell therapy field to expand its CDMO offering to the area where there is a strong imbalance between demand and supply of specific skills and production capacity worldwide, and to better serve the pharmaceutical companies, its patients and society.

Notes:

*1) CDMO: Contract Development and Manufacturing Organization

REFERENCE

Information on Molmed

| Established | 1996 |

| Located | Milan, Italy |

| Number of employees | App. 220 |

| Revenue | 36.3 Million Euros (2019) |

| Business Arena | Gene & Cell therapy Discovery, R&D, Manufacturing, Clinical Validation, Third Party GMP Services |

| Issued shares | 463,450,672 |

| Website | www.molmed.com/en |

Where Molmed fits into AGC’s Business